Rate this post

Ust id prüfen: Are you looking to confirm your VAT identification number? This quick guide will walk you through the process in an easy-to-understand manner.

Firstly, it’s important to understand why verifying your VAT identification number (VAT ID) matters. Your VAT ID is a unique identifier assigned to your business for tax purposes. Verifying it ensures that it’s valid and active, which is crucial for conducting business transactions, especially across borders.

Now, let’s dive into how you can verify your VAT ID:

- Check the Format: Ensure that the format of your VAT ID matches the standard format for your country. VAT IDs vary from country to country, so it’s essential to know what format yours should follow.

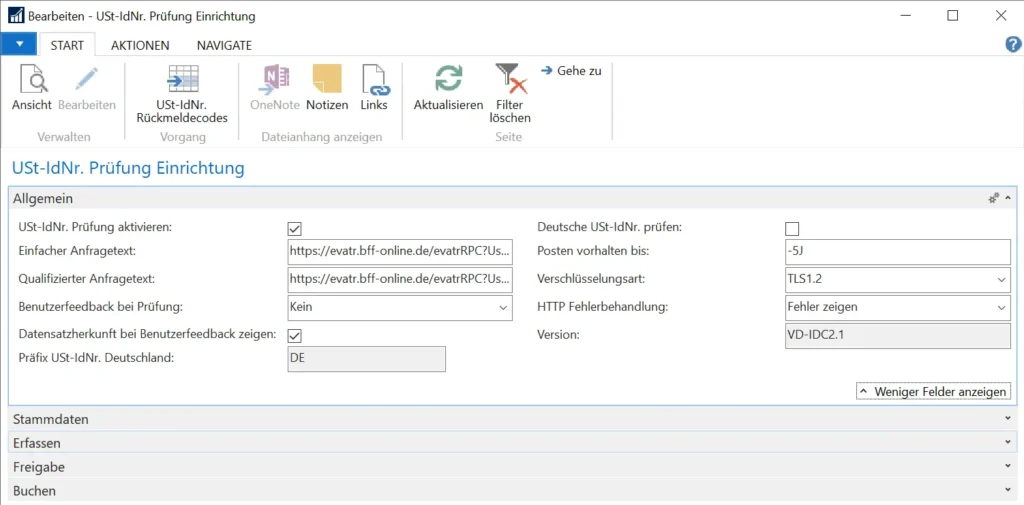

- Utilize Online Tools: Many online tools and databases are available for verifying VAT IDs. These tools allow you to input your VAT ID and instantly check its validity. Government websites or official EU portals often provide reliable verification services.

- Cross-Check with Official Records: You can also verify your VAT ID by cross-referencing it with official records. This might involve contacting your country’s tax authority or checking with relevant regulatory bodies.

- Be Wary of Scams: When verifying your VAT ID, be cautious of scams or fraudulent activities. Ensure that you’re using reputable sources and avoid providing sensitive information to unauthorized platforms.

- Regularly Update Information: It’s important to keep your VAT ID information up to date. Changes in your business structure or tax regulations could affect the validity of your VAT ID, so make sure to update it accordingly.

By following these simple steps, you can easily verify your VAT identification number and ensure smooth business operations. Remember, staying compliant with tax regulations is essential for the success and credibility of your business.

Ust id prüfen: An Essential Step in Business Transactions

In today’s globalized world, conducting business transactions across borders has become a common practice. With the advancement of technology and the ease of communication, companies are able to conduct business with individuals and organizations from around the world. However, amidst this interconnectedness, there are certain legalities that need to be taken into consideration in order to ensure compliance and mitigate any potential risks. One such legal requirement is obtaining and verifying the validity of an ust id, also known as Umsatzsteuer-Identifikationsnummer or VAT identification number. In this article, we will discuss the importance of ust id prüfen (checking ust id) in business transactions.

What is ust id prüfen?

Ust id prüfen is the process of verifying the validity of a company’s VAT identification number. This number is a unique identifier assigned to a company or individual by the tax authorities in their country of residence to facilitate cross-border sales of goods and services within the European Union (EU). It is important to note that not all countries have ust id numbers, and they are only applicable for companies or individuals who are VAT registered within the EU.

Why is ust id prüfen important?

First and foremost, the main purpose of obtaining and verifying the ust id is to comply with the tax laws of the countries involved in the business transaction. In the EU, it is a legal requirement for companies to include a valid VAT identification number on their invoices when conducting business with other VAT-registered entities. Failure to do so can result in penalties and legal consequences. Moreover, ust id prüfen also helps to prevent any fraudulent activities, as it ensures that the company or individual with whom the business transaction is being conducted with is a legitimate and registered entity.

Additionally, verifying ust id can also have financial implications for businesses. In most EU countries, companies are able to claim back VAT paid on business-related expenses through a process called VAT reclaim. However, in order to do so, the invoice must contain a valid ust id. Therefore, failing to verify the ust id of a company can result in the inability to reclaim VAT, leading to financial losses.

How to perform ust id prüfen?

There are various ways to perform ust id prüfen. The most common method is to use the EU’s official VAT Information Exchange System (VIES) tool, which is accessible online and free of charge. This tool allows businesses to check the validity and authenticity of an ust id by entering the number and the country code. The system will then display the company’s details, including its name, address, and VAT registration status. Businesses can also verify ust id by directly contacting the tax authorities in the country of the company in question.

In conclusion, ust id prüfen is a crucial step in conducting business transactions in the EU. It not only ensures compliance with tax laws but also helps to prevent fraud and avoid financial losses. Therefore, it is imperative for businesses to thoroughly verify the ust id of their trading partners before engaging in any cross-border transactions.